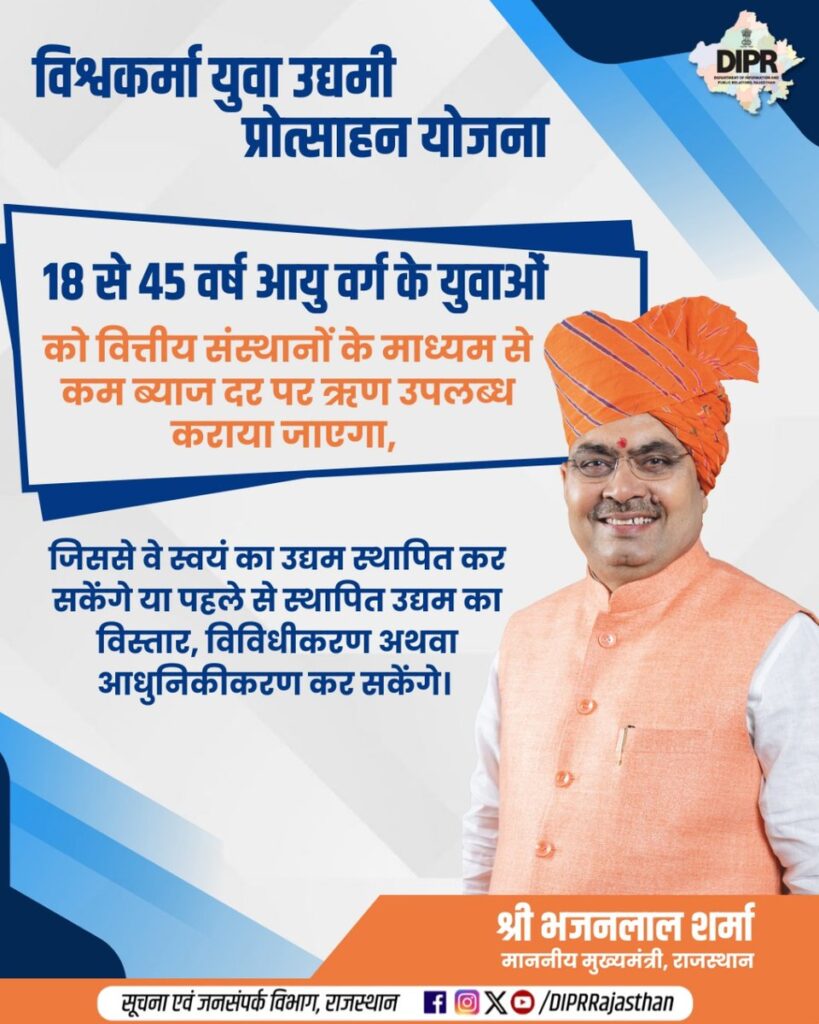

Rajasthan Vishwakarma Yuva Udyami Protsahan Yojana (VYUPY)

Rajasthan Vishwakarma Yuva Udyami Protsahan Yojana is start by the state government of Rajasthan to empower the young generation to start business and contribute to the economy, employment etc. The scheme is applicable only for the business established in the state of Rajasthan.

SEND YOUR QUERY

Rajasthan Vishwakarma Yuva Udyami Protsahan Yojana (VYUPY)

By this content you will understand the below details about the VYUPY:

What is the Vishwakarma Yuva Udyami Protsahan Yojana (VYUPY)?

What is the eligibility creteria of the Vishwakarma Yuva Udyami Protsahan Yojana (VYUPY)?

What are the key benefits of Vishwakarma Yuva Udyami Protsahan Yojana (VYUPY)?

How can you get the benefits under Vishwakarma Yuva Udyami Protsahan Yojana (VYUPY)?

What is the procedure to get benefits under Vishwakarma Yuva Udyami Protsahan Yojana (VYUPY)?

What are the documents you required to apply under Vishwakarma Yuva Udyami Protsahan Yojana (VYUPY)?

What is the Vishwakarma Yuva Udyami Protsahan Yojana (VYUPY)?

Overview of the Scheme:

The Vishwakarma Yuva Udyami Protsahan Yojana (VYUPY) is newly launched scheme of state government of Rajasthan specially encourage to youth for setup new business in the state and generate more employment. The government provides mainly Interest subsidy and margin money capital subsidies to eligible young business entrepreneur.

The Administrative Department of this scheme is District Industrial Centre.

Effective Period of the scheme: The scheme is effective from the notification date to 31, March, 2029.

Eligible sector: The scheme is valid for setup of new manufacturing and service-based Unit.

Type of entities: The scheme is eligible for Individuals, Partnership firms, Companies, LLP etc.

Applicability: The scheme applicable in the state of Rajathan only.

Objectives

The main objectives behind launching this scheme are:

Self-Employment: one of the main objectives of the scheme To encourage and support the establishment of self-owned enterprises by the youth of Rajasthan.

Low-Cost Credit: another main objective of the scheme to make credit available at a low cost for setting up a new enterprise or for the expansion, diversification, or modernization of an established one.

Job Creation: To create new employment opportunities by making funding readily accessible.

Financial Leverage: To ensure easy access to loans, enabling entrepreneurs to better utilise other Central/State Government schemes for subsequent stages of their business.

What is the eligibility creteria of the Vishwakarma Yuva Udyami Protsahan Yojana (VYUPY)?

To get benefit and qualify for the scheme, you must meet the following criteria:

Age and Enterprise Status

Individual Applicants: The Individual applicant’s age must be between 18 years to 45 years.

Institutional Applicants (Firms/Companies etc.): The institution which want to apply for the benefit of the scheme must have major ownership vested in individuals aged between 18 and 45 years.

Enterprise Type: According to the scheme only Micro and Small Enterprises (as per the Government of India’s defined limit at the time of application) in the manufacturing and service sectors are eligible for the loan and interest subsidy.

Registration: Institutional applicants must be duly registered as per applicable rules.

Not eligible

The applicant or enterprises will not be eligible under the scheme in the following circumstances:

Defaulters: Applicants who are defaulters or guilty in any financial institution/bank.

Prior Subsidies: The beneficiary unit is not eligible if it has availed of any capital subsidy or interest subsidy under any Central or State Government scheme in the preceding 5 years for the benefit received component.

What are the key benefits of Vishwakarma Yuva Udyami Protsahan Yojana (VYUPY)?

Nature of Financial Assistance (Loan/Subsidy Details)

Financial assistance will be provided in the form of loan limits, margin money, and interest subsidies.

Loan Provisions of the scheme

Maximum Loan Limit: Maximum loan of ₹2 Crore will be provided for the establishment of new enterprises and for expansion /modernization /diversification.

Use of Loan: The loan amount which is sanctioned in the scheme can be used for land, plant and machinery, work shed/building, furniture, equipment and working capital for the unit.

Land & Building Cap: If land and building are part of the project and cost, the interest subsidy in scheme will be applicable only up to a maximum limit of 25% of the total loan amount used for land and building.

Self-Contribution: The applicant has to provide a minimum 10% amount of the project cost as self-contribution.

Loan Form: The sanctioned loan will be in the form of a Composite Loan or solely a Term Loan, depending on the project requirement. The working capital loan will only be eligible as a Cash Credit (CC) Limit.

Interest subsidy:

Sr. No. | Maximum Loan Amount | General Interest Subsidy |

|---|---|---|

1. | Upto 1 Crore | 8% |

2. | Above ₹1 Crore and up to ₹2 Crore | 7% |

Additional Interest Subsidy (1%):

Additional 1% subsidy of interest will be available on loans above ₹1 Crore to ₹2 Crore categories like as under:

Women applicant, SC/ST, and Persons with Benchmark Disabilities entrepreneurs.

Enterprises established in rural areas.

Weavers holding a Weaver Card.

Artisans/Craftsmen holding an Artisan/Shilpi Card.

Note: If the financial institution’s interest rate is equal to or less than the subsidy rate mentioned above, 100% interest subsidy will be provided.

Margin Money Subsidy

Subsidy Amount: A margin money subsidy will be provided, amounting to 25% of the loan provided by the financial institution, or ₹5 Lakh, whichever is less.

Adjustment: This amount will be deposited as a short-term deposit with the financial institution. After operating the enterprise for 3 years following its establishment, and provided the borrower has not defaulted, this amount will be adjusted into the borrower’s account following a departmental inspection.

Implementation & Nodal Departments

Administrative Department -The administrative department of the VYUPY scheme is Industries and Commerce Department of Rajasthan.

Ground-Level Agency: Ground Level agency of The scheme who will work on this will be implemented through the District Industries and Commerce Centres operating in the districts of Rajasthan states.

State-Level Nodal Agency: The Office of the Commissioner, Industries and Commerce, will be the nodal agency for state-level implementation work and supervision work.

Guidance Authority: The Commissioner, Industries and Commerce, Rajasthan, will holds the rights for interpretation, guidance, implementation, and monitoring of the scheme.

How can you get the benefits under Vishwakarma Yuva Udyami Protsahan Yojana (VYUPY)?

Process for apply under VYUPY:

Loan eligibility:

The financial institutions which loans are eligible for get benefits under VYUPY are Schedule Commercial Banks, Private Banks, small financial bank, Regional Rural Banks (RRBs), Rajasthan Financial Corporation (RFC), SIDBI, and other Cooperative Banks.

Application Process

Application: The scheme will be implemented through an online portal.

Scrutiny of the application: A District Level Task Force Committee (DLTFC) will be formed for the scrutiny and examination of application forms.

Approval and Forwarding: Once the application approved by the district level task force committee, the recommendation will be forwarded to the applicant and the file will be move further to the respective bank.

Please Note: If the Loan directly sanctioned by financial institutions it will not be eligible for benefits under this scheme. DLTFC approval before loan sanction is mandatory.

What is the documents required under Vishwakarma Yuva Udyami Protsahan Yojana (VYUPY)?

The documents key documents required for get approval under the scheme Vishwakarma Yuva Udyami Protsahan Yojana (VYUPY) are as below:

Pan Card and Adhar card of the Proprietor/ partners/ directors (as the case may be)

MSME Certificate

BRN (Sanstha Aadhar)

Firm registration certificate

Partnership deed (in case of partnership firm)

Certificate of incorporation with MOA & AOA (in case of company)

Project report

Photos of applicant

Other documents as per requirement

OTHER TERMS & CONDITIONS:

Conditions for Beneficiaries

Proper Use of Loan: The sanctioned loan amount under the scheme must be used only for the purpose for which it was sanctioned for.

Subsidy Period: The maximum period for interest subsidy under the scheme will be 5 years from the date the establishment starts production/operation.

Moratorium Period: A maximum 6-month Moratorium Period on loan repayment may be granted. Interest subsidy will be payable even during this period, provided interest payments are made regularly.

NPA Regularisation: If your loan account is classified as an NPA (Non-Performing Asset) by the bank or loan sanctioning authority, but is subsequently regularised by the entrepreneur/enterprises, the interest subsidy and other benefits of the scheme for that period will become payable.

Disqualified Activities under the scheme

The following activities are not eligible for the scheme:

Manufacturing and sale of products made from meat, liquor and intoxicants.

Explosive and related materials.

Commercial transport vehicles which on-road price more than ₹15 lakh.

Agriculture and allied related activities which also includes animal husbandry, poultry and fisheries.

Mining and real estate related activities.

Activities operated by non-profit organisations like any NGOs, Trusts etc.

FAQs

Question 1. How long is the VYUPY valid?

Answer. The VYUPY scheme is effective until March 31, 2029.

Question 2. What is the maximum loan limit under VYUPY scheme?

Answer. The maximum loan limit under VYUPY scheme is ₹2 Crore.

Question 3. Do I have to repay the Margin Money Subsidy?

Answer. No, provided you operate the enterprise for 3 years and do not default, the amount will be adjusted into your loan account.

Question 4. What is the maximum subsidy period under VYUPY scheme?

Answer. The interest subsidy under VYUPY scheme is available for a maximum period of 5 years from the start of production/operation.

Question 5. Can I apply for a loan for agriculture under VYUPY scheme?

Answer. No, you cannot eligible for agriculture and allied activities (including animal husbandry and fisheries) under VYUPY scheme.

Question 6. Is DLTFC approval mandatory?

Answer. Yes, loan cases directly sanctioned by a bank without the DLTFC recommendation will not be eligible for scheme benefits.

What Type of FSSAI License should required ?

Type of FSSAI License is merely depending on food operator’s business turnover, production capacity, type of activity and area of business.

FSSAI Basic Registration

FSSAI Basic Registration

When a food operator’s business is small-size, start-up and having their annual turnover upto Rs. 12 Lakh per annum they can get FSSAI Basic Registration.

FSSAI Basic Registration

FSSAI State License

FSSAI State License

If the business turn over is more than Rs. 12 Lakh and upto 20 Crore per annum this type of business should obtain FSSAI State License.

FSSAI State License

FSSAI Central License

FSSAI Central License

It is required when the Food Operators business having turn over above 20 Crore per annum and also required when the FOB’s supply the food to government offices and involving in import export of goods.

FSSAI Central License

Process to get loan under VYUPY Scheme:

STEP 1

STEP 1

Post Your Query to Legalman

STEP 1

STEP 2

STEP 2

Send documents through e-mail

STEP 2

STEP 3

STEP 3

Your project report and other documentation preparation work will be completed by our experts

STEP 3

STEP 4

STEP 4

After properly completion of your application they will apply and follow up to DIC Govt. Office to approve your file

STEP 4

STEP 5

STEP 5

After getting the approval of your submitted file from DIC Office, your file will be further forwarded to your proposed bank.

STEP 5

STEP 6

STEP 6

The bank will check all formalities, your credit potential and projection viability then your file will be processed finally and disbursed the loan amount.

STEP 6

FSSAI Food License Requirement

Dedicated team

Legal Man have dedicated team of experts Chartered Accountants, Company Secretary, Lawyers to process your error less application.

Best Consultancy

Legal Man Team’s provide best consultancy to choose applicable license.

Time Value

Our team respect your time and provide fastest service ever.

MoneyBack Guarantee

If your work not done, Legal Man will refund you entire amount except govt. fee if paid